Banking giant Citi Bank has made a strategic investment in equity and ESOP management platform Qapita. With this strategic investment, Citi has joined Qapita’s ongoing Series A round. The company had already raised $15 Mn in the earlier tranche of Series A that was co-led by East Ventures (Growth Fund) and Vulcan Capital.

Qapita has refused to divulge the exact amount of investment that Citi Bank has made in the company. The company will use the fresh funds for launching a private company marketplace. This digital marketplace will help private companies in reporting and managing all aspects of equity ownership (ESOPS and cap tables). Additionally, it will setup and run friendly liquidity programs and build standardized & scalable rails for private market transactions.

Commenting on Citi’s strategic investment, Ravi Ravulaparthi, CEO and Cofounder of Qapita, said, “Our quest is to build a unified platform that addresses all matters relating to equity for a private company. The private market in this part of the world is set to be US$1.0 – 1.5 trillion in value. This market needs an operating system and transaction rails to make it transparent, accessible and efficient. This partnership with Citi will help us accelerate this mission. We look forward to more such partnerships with ecosystem players.”

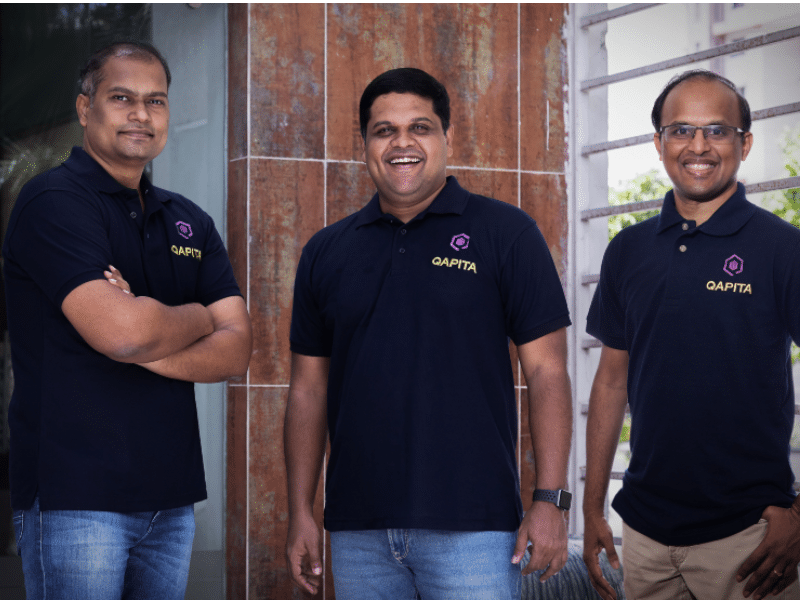

Based in Singapore, Qapita was founded in 2019 by Ravi Ravulaparthi, Lakshman Gupta and Vamsee Mohan. The startup is basically a fintech and LegalTech SaaS startup that offers equity management software for private companies. The company’s predominant service includes cap table management and ESOP management. The young company is especially focused on rendering its services to startups.

Over the last few years, startups have become heavily dependent on ESOPs to retain talent and workforce especially during the tormenting time of COVID lockdown.