Kunal shah’s fintech startup Cred has become the latest unicorn in India’s burgeoning startup industry, after raising $225 Mn in a series D round at an eye popping valuation of $2.2 Bn. Falcon Edge Capital led the round while existing investor Coatue along with set of existing as well as new investors also participated in the round.

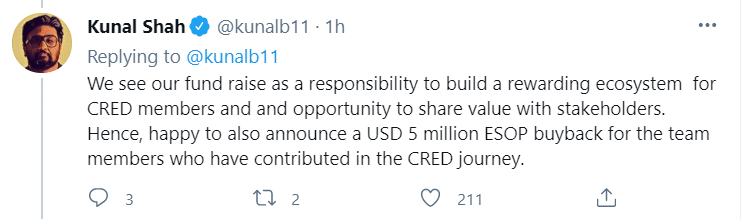

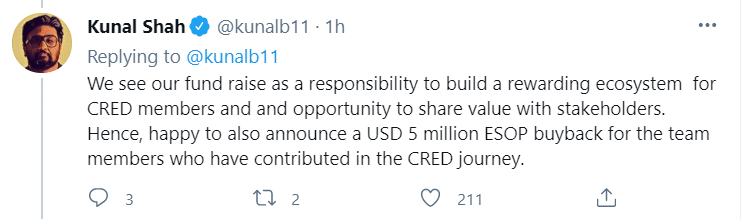

With the latest capital infusion, Cred has successfully closed the series D round. It has also announced another ESOP buyback worth $5 Mn. It is worth noting that the company had bought employee stock options worth $1.2 Mn during its series C round.

Cred’s valuation has seen a sporadic jump during last three months, with its valuation soaring by almost 3X since January, when it was valued around $800 Mn.

On the sidelines of fresh fundraising, Kunal Shah took to Twitter to tweet on several important issues: Below are the screenshot of Kunal Shah’s tweets:

Kunal Shah’s tweet on ESOP buyback

Kunal Shah’s tweet sharing Cred member’s financial progress for the month of March

Cred is essentially a credit card reward platform that rewards users for paying their bills on time. Users can subsequently avail these rewards and discounts on various products.

Since starting Cred, Shah has been arguing that credit card penetration in India is still low and debit card is still the preferred mode of payment. However, Shah has been categorically insisting that his company would be chasing the premium credit card users and not the mass segment.

Shah was recently in news for investing in Carl Pei’s newly launched startup Nothing. Additionally, few months back Shah had invested in debt asset management platform Wint Wealth (earlier known as GrowFix).

Techpluto had recently conducted an exclusive interview with GrowFix’s Co-founder Ajinkya Kulkarni. To read the interview, please click here.

Cred’s founder is not only a well-known serial entrepreneur but is widely hailed as one of the poster boys of India’s startup ecosystem. Before starting Cred, he had founded online payment startup Freecharge, which was acquired by Snapdeal in 2015 , in what was at that one of the biggest acquisition deals in India’s startup industry.

Since Cred has now become the sixth startup to join the coveted unicorn club, here is a list of five other startups that earned this coveted tag this year…

- Digit Insurance

- Innovaccer

- Market

- Meesho

- Five Star Business Finance