Hyperlocal startup Dunzo has received second tranche from existing investors Lightbox and Moving Capital in the on-going series E round that is nearly worth $28 Mn. While the existing investors Google and Lightstone have already pumped $15 Mn in the first tranche, in the second tranche Lightbox and Moving Capital have collectively infused nearly INR 63 crores. The remaining amount will be pumped in three separate tranches, as per the regulatory filings.

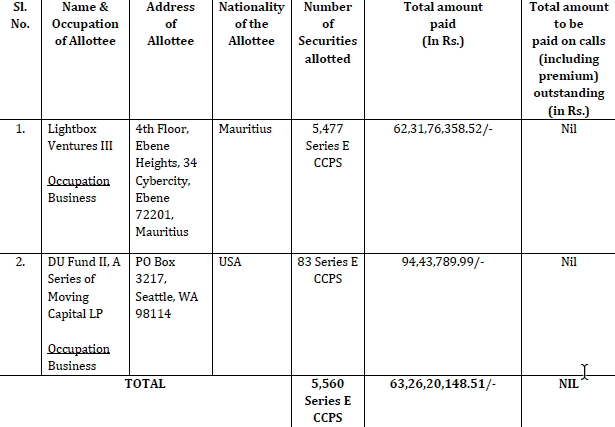

According to the regulatory filings, 5,477 preference shares have been allotted to Lightbox and 83 preference shares have been allotted to Moving Capital. The below table shows the breakdown of the share allotment and the capital contributed by the two investors.

As per the regulatory filings, the remaining three tranches are likely to be funded by 3L Capital, Pivot Ventures Family, Bhoruka Finance Corporation and co-founder & CEO Kabeer Biswas. Regulatory filings show that these investors have already been allotted preference shares.

The fresh investment has come at a time when competition in hyperlocal space is intensifying, with Swiggy and Flipkart recently launching their own hyperlocal services. According to reports, the Bengaluru headquartered company is flirting with dark stores to make its delivery services more efficient. As unconfirmed reports, the company current operates 10 dark stores across Bengaluru, Chennai and Pune.

The last financial year (i.e. FY19) wasn’t exactly a good year for Dunzo, with the company clocking a loss of Rs 16.89 crores for a meager revenue of Rs 76 lakhs. However, the company seems to have made a turn-around in FY20, with its unaudited financial statement filed with the ROC showing that company’s unit economics quite drastically during the first 10 months of FY20. The company is yet TO file its audited financial statement for FY20.