Epharmacy startup PhramEasy made a surprising announcement on Friday that it is acquiring a controlling stake in Thyrocare Diagnostic Technologies Ltd for INR 4,546 Cr. The controlling stake amounts to nearly 66.1% stake at per share valuation of Rs 1,300.

It is probably for the first time that an emerging startup, which is barely few years old, is buying a highly successful listed company. This, in a way, will be again perceived as an apparent sign that Indian startup is indeed reaching a maturity level. This news comes close on the heels of BharatPe joining hands with Centrum to rescue PMC Bank, which again makes for a positive story for India’s startup industry.

PhramEasy is also sitting on a good cash reserve. The company had recently raised $350Mn at an eye-popping valuation of $1.5Bn, becoming the first Epharmacy startup to hit the unicorn valuation. Besides, the company is eyeing an IPO but it has not set any definite deadline for the same.

Thyrocare’s acquisition will pave way for PharmEasy’s foray into the diagnostics space and allow the company to build a new vertical. This new vertical will have no correlation with company’s main flagship business of selling online medicines. This new vertical, by the way, will certainly put the company on a strong footing as it seeks investors support for successful IPO listing.

With IPO listing in mind, PhramEasy is shaking up things in a big way. It recently onboarded banking veteran and former HDFC CEO Aditya Puri on its board of directors team.

Thyrocare was listed on stock exchange in 2016 at a market valuation of INR 3.300 Cr. The company’s stock debuted on the street at INR 565 per share. Since then the company’s share has jumped nearly 156% and on Friday (i.e. 25/6/2021) the stock closed at a price of INR I,450.

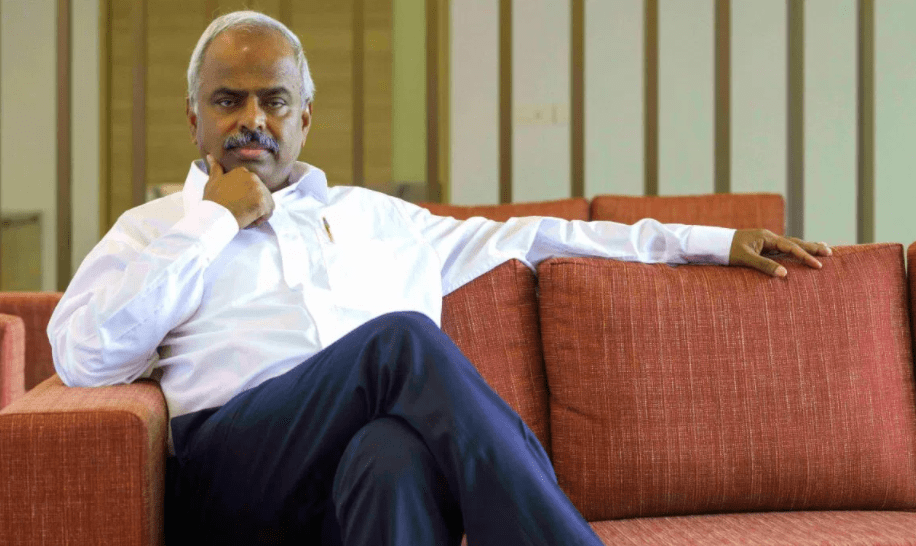

At the heart of Thyrocare’s stellar success is Dr A Velumani, whose rags to rich story is widely hailed as India’s great entrepreneurial success.