E-commerce focused logistic startup Delhivery has received $25 Mn from global tech Fund Steadview through secondary transaction. Since this investment has been made through sale of secondary shares, Delhivery will be using the investment purely for giving exit to early investors.

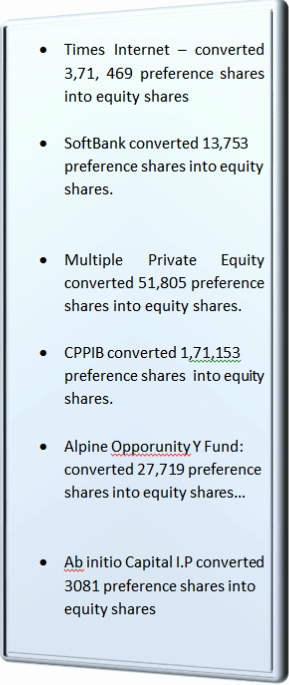

However, the names of existing investors who have sought to make an exit have not been officially disclosed. But Techpluto had reported back in September that several of Delhivery’s existing investors including SoftBank and Nexus Partners had converted their preference shares into ordinary shares to seek partial exit from the company.

It is most likely that these same investors have sought partial exit from this secondary sales. To know the complete list of these investors, please check the sidebar. The concerned information has  been sourced from Delhivery’s regulatory filings.

been sourced from Delhivery’s regulatory filings.

To know more about existing investors stake in Delhivery post stake sale, please click here.

Delhivery has now become the second unicorn startup to give an exit to its early investors through a secondary transaction. Few weeks, online cosmetics marketplace Nykaa also gave exit to many existing investors after Fidelity invested an undisclosed amount via secondary transaction.

Top E-commerce Logistic Players

- Delhivery

- Ecom express

- Xpressbees

- Shadowfax

- Ekart

It must be noted that only last month Xpressbees had raised $110 Mn in series E round.

To read the complete interview of Shadowfax’s co-founder Abhishek Bansal’s 2018 interview with Techpluto, click here.

There is little doubt that E-commerce logistic industry’s fortunes are closely intertwined with the e-commerce industry. Hence for the long-term growth of this industry, it is critical that the e-commerce industry keeps growing at an impressive rate.

The good news is that India’s e-commerce industry is poised for higher trajectory growth in the coming years. It is roughly estimated that India’s e-commerce market is expected to become a whopping $200 Bn market opportunity by 2026. With such impressive growth projection of the E-commerce industry, e-commerce logistic players can be optimistic about their future growth.

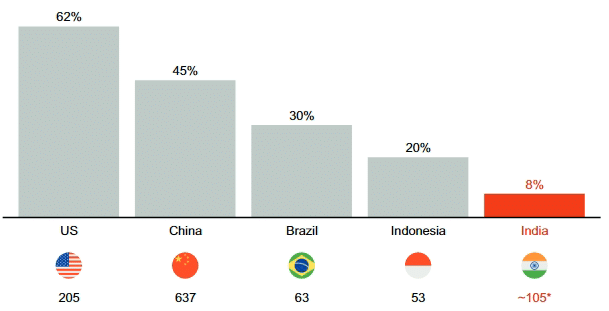

However, India’s e-commerce industry continues to face some real challenges. For instance, online shopping penetration in India remains very low as compared to other countries. According to latest report by Sequoia and Bain company, only 8% Indians shop online whereas 45% Chinese shop online as of 2020.

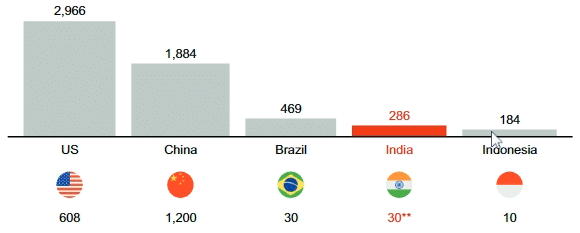

Additionally, the average online spending still remains low in India, with Indians annually spending only $286 per year. This is extremely as compared to other countries like China and Brazil, which spends an average $1884 and $469 respectively every year on online shopping.

For more clarity, check out the below charts…