Unacademy on Thursday announced that it has acquired leading UPSC CSE prep platform CourSavy for undisclosed amount. This is Unacademy’s fifth acquisition this year, after having acquired Kreatryx, PrepLadder, Mastree and CodeChef. This is also edtech major’s first acquisition after becoming unicorn following SoftBank led $150 Mn funding round earlier this month.

The newly crowned unicorn has said that CourSavy’s founder Vimal Singh Rathore including his team will join the company. According to regulatory filings, Unacademy has allotted 60 equity shares to Vimal Singh Rathore under its ESOP plan. With this allotment, company’s ESOP pool has reduced from 65017 to 64,957 shares.

Unacademy has said that its latest acquisition (I.e. CourSavy) will further strengthen company’s dominant leadership position in the UPSC CSE prep market and overall test prep market.

The official press release said that Coursavy has developed a scalable learning platform and process which solves the challenge of lack of discipline in learning. On its official website, CourSavy describes itself as ‘India’s first education initiative focusing on daily discipline & personalized learning.’

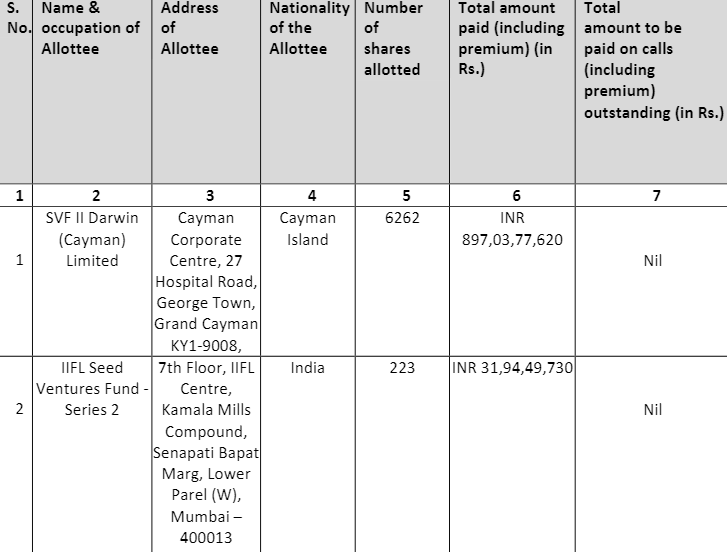

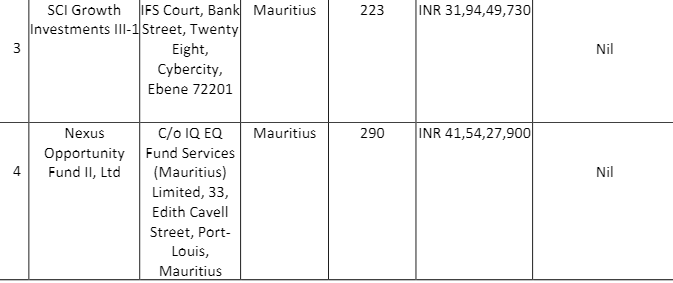

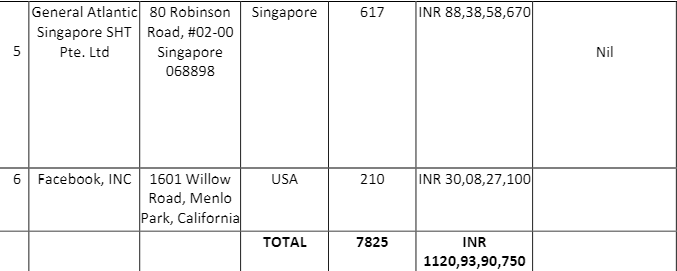

Meanwhile, Unacademy has filed share allotment and private placement offer of the Series F funding round with the ROC. The $150 Mn funding round, which was led by SoftBank, saw participation of existing investors Facebook, Sequoia, Nexus Venture Partner and Blume Ventures.

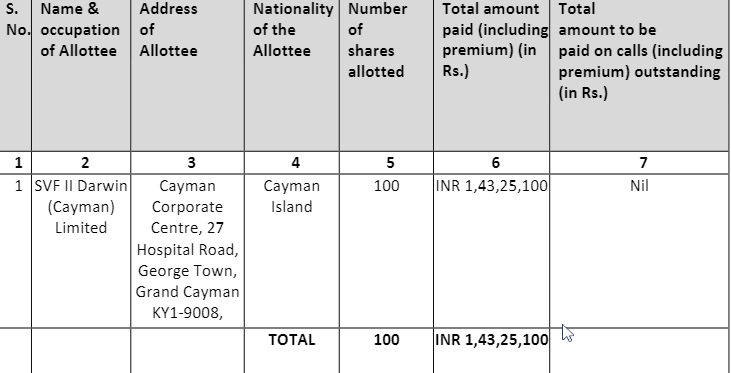

As per the regulatory filings, SoftBank has been allotted 100 equity shares at rate of INR 1,43,250 per equity shares. SoftBank has also been allotted 6262 preference shares at rate of 14,32,410 per preference shares. The Japanese tech investor is the only investor among 6 investors that has allotted equity shares.

The below table shows the complete breakdown of the share-allotment for the Series F round led by SoftBank.

SoftBank Equity Share allotment

Preference share allotment